Crédit Mutuel incorporated climate objectives into the consolidated action plan which it approved in 2021 to align its activities with the climate targets of the Paris Agreement.

Risks and opportunities

Climate and environmental risks entail factors that have a decisive impact on existing risks, in particular credit, operational, market and liquidity risks. These risks are automatically integrated into the group’s risk management processes.

They also represent an opportunity for Crédit Mutuel to support the transition to a more low-carbon economy. It is, in fact, vital that the transition is viewed as an opportunity to fund and help build a future economy, by adapting business strategies and models.

The Crédit Mutuel group's goal is to integrate these risks and opportunities throughout its strategy and activities. This involves each regional group taking ownership of these issues as they deploy their own climate strategies.

A dual materiality principle applies when taking climate and environmental risks into account:

- on the one hand, consideration of the potential and proven impacts of climate change and environmental risks on all of the group's activities;

- on the other hand, consideration of the impacts of these activities on climate and environmental factors.

Analyse de significativité

Afin d’avoir une vision holistique et bien documentée de l’incidence des risques liés à l’environnement sur les catégories de risques existantes, le groupe Crédit Mutuel a élaboré deux matrices de matérialité nationale une pour les risques liés au climat, l’autre pour les risques liés à la nature

Ces deux analyses de significativité ont été élaborées à dires d’experts, en co-construction avec les groupes régionaux et les responsables des risques concernés. Les principes méthodologiques sont détaillées dans le rapport de durabilité du groupe Crédit Mutuel.

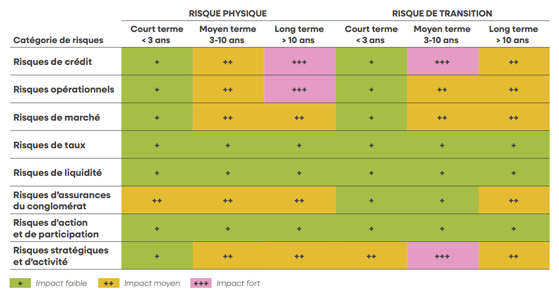

Matrice de matérialité des risques climatiques du groupe Crédit Mutuel

| Risque physique | Risque de transition | |||||

|---|---|---|---|---|---|---|

| Catégories de risques | Court terme < 3 ans |

Moyen terme 3-10 ans |

Long terme > 10 ans |

Court terme < 3 ans |

Moyen terme 3-10 ans |

Long terme > 10 ans |

| Risque de crédit | + | ++ | +++ | + | +++ | ++ |

| Risque opérationnels | + | ++ | +++ | + | ++ | ++ |

| Risque de marché | + | ++ | ++ | + | ++ | ++ |

| Risque de taux | + | + | + | + | + | + |

| Risque de liquidité | + | + | + | + | + | + |

| Risque d'assurance du conglomérat | ++ | ++ | ++ | + | + | ++ |

| Risque de la participation | + | + | + | + | + | + |

| Risque stratégique et risque d'activité | + | ++ | ++ | ++ | +++ | ++ |

| +++ Impact fort +++ Impact moyen +++ Impact faible |

||||||

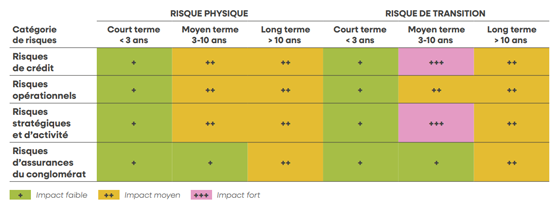

| Figure 1 Matrice de matérialité des risques liés à la nature 2024, avec la cotation suivante : + = faible ; ++ = moyen ; +++ = fort. | ||||||

Matrice de matérialité des risques liés à la nature du groupe Crédit Mutuel

| Risque physique | Risque de transition | |||||

|---|---|---|---|---|---|---|

| Catégories de risques | Court terme < 3 ans |

Moyen terme 3-10 ans |

Long terme > 10 ans |

Court terme < 3 ans |

Moyen terme 3-10 ans |

Long terme > 10 ans |

| Risque de crédit | + | ++ | ++ | + | +++ | ++ |

| Risque opérationnels | + | ++ | ++ | + | ++ | ++ |

| Risques stratégiques et d’activité | + | ++ | ++ | + | +++ | ++ |

| Risques d’assurances du conglomérat | + | + | ++ | + | + | ++ |

| +++ Impact fort +++ Impact moyen +++ Impact faible |

||||||

| Figure 1 Matrice de matérialité des risques liés à la nature 2024, avec la cotation suivante : + = faible ; ++ = moyen ; +++ = fort. | ||||||

A bank committed to the energy transition

Crédit Mutuel supports the development of the energy and ecological transition through dedicated loans. With total outstandings of €34,665 million, the Crédit Mutuel group reasserts its determination to work closely with the regions, supporting professionals, farmers and individuals in the ecological and energy transition by providing structured financing and through its retail banking activity which has a well-established energy transition financing offering.

| (€ millions) | 2021 | 2020 |

|---|---|---|

| Financing the energy transition (renewable energy outstandings + loans for energy renovation of buildings + ecological equipment for professionals and farmers + financing of green vehicles) | 28,123 | 23,466 |

| Amount of structured financing for renewable energies | 2,100 | 1,800 |

| Outstanding loans granted to businesses and farmers for renewable energies | 165 | 177 |

| Loans for financing new housing that complies with the RT 2012 standard | 24,906 | 20,961 |

| Outstanding interest-free green loans granted during the year | 604 | 528 |

| Outstanding clean vehicle loans | 287 | NC |

| Outstanding energy transition loans | 61 | NC |

| Assets held in LDDS sustainable development and solidarity savings accounts | 20,249 | 18,996 |

Les opportunités

Afin d’accompagner 100 000 clients dans leur transition énergétique d’ici 2027, objectif fixé dans le plan stratégique Ensemble Performant Solidaire, Crédit Mutuel Alliance Fédérale poursuit le développement de sa filière rénovation énergétique. Avec notamment le lancement en juin 2024, d’une marque dédiée à cette nouvelle activité. Homji est une plateforme proposant un accompagnement global aux particuliers tout au long du projet pour lever les principaux freins à la rénovation énergétique de leur logement.

Le Crédit Mutuel Arkéa accompagne la transition environnementale en proposant notamment à ses clients des offres de financement dédiées à l’accompagnement environnementale ainsi que des solutions d’épargne vers des produits contribuant à la transition environnementale. Dans ce cadre, le groupe s’est engagé sur des volumes d’encours à 2027.

Le groupe Crédit Mutuel soutient le développement de la transition énergétique et écologique, au travers de prêts dédiés.

Le Crédit Mutuel Arkéa, sa filiale Arkéa Banque Entreprises et Institutionnels, commercialise depuis 2023 l’offre de crédit Pact Carbone qui permet à ses clients volontaires de bénéficier d’un bilan carbone et d’une bonification du taux d’intérêt en fonction de la réduction de son intensité carbone. En outre, le prêt Pact Carbone attribue une sur-bonification visant à valoriser les contreparties ayant atteint un objectif de réduction en ligne avec une trajectoire carbone compatible avec les objectifs de l’Accord de Paris. La mesure carbone et la définition de la trajectoire sont réalisées par un organisme tiers indépendant. Un rapport est remis deux fois par an au client.

Et au Crédit Mutuel Alliance Fédérale, le cumul des encours de crédits octroyés dans le cadre de la gamme Transition (prêts adossés à des objets de transition environnementale, sociale ou de gouvernance, ou bien prêts adossés à des engagements extra-financiers) s’élève à près de 6,9 milliards d’euros au 31 décembre 2024.